Top 10 Tips for Mortgage Borrowers for 2014

The clock is ticking for buyers and homeowners who want to grab a low mortgage rate in 2014. But if you stay on top of your game, keep your finances in order and act quickly, you can still grab attractive mortgage deals.

These 10 mortgage tips can help you with your mortgage decisions in 2014.

1. Document your finances

Lenders will be extra diligent when underwriting home loans in 2014, as new mortgage regulations go into effect in January. The rules put pressure on lenders to verify that borrowers have the ability to repay their loans.

Keep good records of your finances, including bank statements, tax returns, W-2s, investment accounts and any other assets you own. Be ready to explain any unusual deposits to your accounts. Yes, the $500 that Grandma deposited in your account for Christmas could delay your loan closing if you can’t prove where the money came from.

2. Lock a rate as soon as you can.

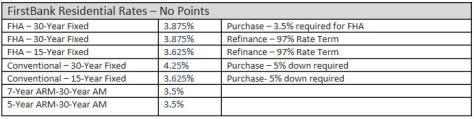

Rates will likely climb in 2014 as the Federal Reserve is expected to reduce the pace of the economic stimulus program that has long helped keep rates low. If you are planning to get a mortgage, lock in a rate as soon as you are comfortable with the numbers.

3. Refinance now – if you still can.

Many homeowners lost the opportunity to refinance at a lower rate when rates jumped in 2013. But those who are still paying more than 5 percent interest on their home loans might still have an opportunity.

If you think you may be able to save with a refinance, but you are not sure, it doesn’t hurt to try. Speak to a loan officer and take a look at the numbers to see if refinancing still makes financial sense for you after you consider how long it will take to break even with the closing costs.

4. Buyers – use your bargaining power

As mortgage rates climbed, lenders lost a big chunk of their refinance business. In 2014, they will turn their attention to homebuyers and will fiercely compete for their business. Buyers should take advantage of bargaining power they gain with that increased competition. Shop around for the best deal and look beyond the interest rate on the loan.

5. Learn your rights as a borrower

Mortgage borrowers will get many new rights as consumers this year when new mortgage rules created by the Consumer Financial Protection Bureau go into effect in 2014. If you run into issues with your mortgage servicer in 2014 or fall behind on your payments, make sure you are aware of your rights and put them to use.

6. Take good care of your credit

It’s nearly impossible to get a mortgage without decent credit these days. That will continue to be the case in 2014. If you are planning to get a mortgage, monitor your credit history and score until your loan closes. The best mortgage rates usually go to borrowers with credit scores of 720 or higher. You may still get a mortgage with a score of 680, but lower scores will mean higher rates or higher closing costs.

7. Don’t overspend

Lenders don’t want to give out loans to borrowers who will have little money left each month after they pay their mortgages and other debt obligations such as credit cards and student loans. If that becomes the case, the lender will tell you that your DTI, or debt-to-income ratio, is too high and you don’t qualify for a loan. Try to keep your monthly debt obligations, including your mortgage and property taxes, below 43 percent of your income.

8. Consider alternative mortgage options such as ARMs

Mortgage rates are rising, but there are alternatives to grab a lower rate, depending on your plans.

A homeowner planning to keep a house for seven to 10 years could take advantage of lower mortgage rates by choosing a seven- or 10-year ARM instead of the 30-year traditional fixed-rate mortgage. Rates on adjustable-rate mortgages can be as much as one percentage point lower than on fixed-rate loans.

If you are not sure for how long you plan to keep the house, a fixed-rate loan is probably the better choice.

9. Considering an FHA Loan? –

FHA loans have long been popular among first-time homebuyers because they require low down payments and have somewhat less strict underwriting standards than conventional loans. But they come at a price. Mortgage insurance premiums on FHA loans are likely to continue to rise in 2014, and after recent changes, the borrower is now required to pay for mortgage insurance for the life of the loan. Try to qualify for a conventional loan before you apply for an FHA mortgage.

10. Don’t panic

Yes, mortgage rates will likely climb in 2014. But don’t panic, thinking you have to buy a home now to grab a low rate. If you are shopping for a home, do your best to move quickly, but remember that this is one of the biggest financial decisions of your life. Get your mortgage and buy your home when you feel ready.

If you are thinking of buying or selling a home, talk to a REALTOR who can give you the information you need to make an informed decision.

As always, if I can help with any of your real estate needs, please don’t hesitate to drop me an email at RolandLow1@gmail.com.

Roland

source: Polyana da Costa, Bankrate.com